Inland Revenue Department (IRD)

Sri Lanka

Hire a Duthaya to stand in line and get your work done at Sri Lanka’s Inland Revenue Department (IRD). Allow our Duthaya to work on your behalf while you devote your time to more important matters.

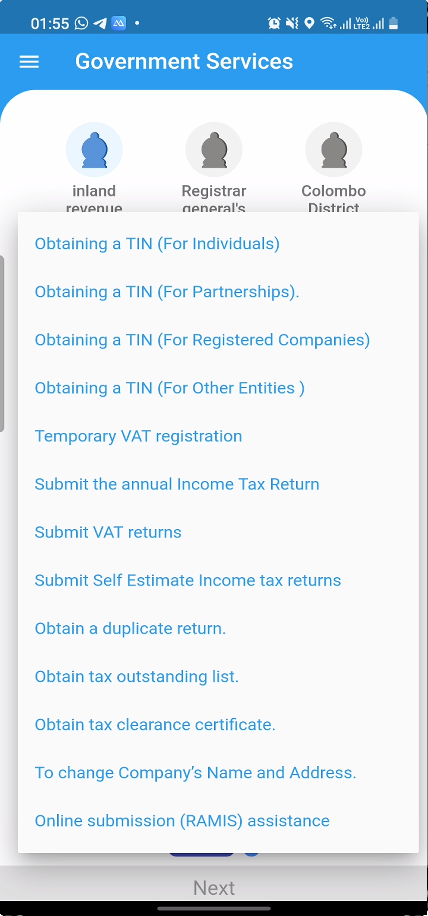

The following are ten critical services that the Inland Revenue Department facilitates for someone other than the relevant person to perform on behalf of the designated business owner or business representative. So, a duthaya can perform the following ten services behalf of you

Obtaining a TIN (For Individuals)

- Application Form for Taxpayer Registration (For Individual and Proprietorship) – Download

- NIC (Sri Lankans) or Valid Passport (Foreign Nationals)

- Business Registration Certification (if a Proprietorship is to be added)

- Utility Bill / Statement of Bank Account or Passbook / Grama Niladhari Certificate (if address is different from NIC). For foreigners’ local address proof is required)

If you require any additional information or clarification, please contact our call center at 074 2000 930

Obtaining a TIN (For Partnerships)

- Application Form for Taxpayer Registration (For Partnership / Joint Venture / Project) Download

- Partnership Registration Certification

- NIC (Sri Lankans) or Valid Passport (Foreign Nationals) of all the partners

If you require any additional information or clarification, please contact our call center at 074 2000 930

Obtaining a TIN (For Registered Companies)

- Application Form for Taxpayer Registration (For Company) – Download

- Certificate of Incorporation (Form 2A/2D/42/41 etc.)

- Form 01/05/40 certified by Registrar of Companies.

- All Form 20s certified by Registrar of Companies.

- NIC (Sri Lankans) or Valid Passport (Foreign Nationals) of all directors

- Form 13 certified by Registrar of Companies (If applicable)

- Form 18 certified by Registrar of Companies, if Form 20 is obtained to recognize director’s signature.

- Articles of Association

- Registration certificate issued by the Board of Investment and relevant agreement

If you require any additional information or clarification, please contact our call center at 074 2000 930

Obtaining a TIN (For Others Entities)

- Application Form for Taxpayer Registration (For NGO / Charity / Co-op /Associations & Clubs / Semi Government Institutions / Government Institutions / Provident Fund / Trust / Embassy / High Commissions / Others) – Download

- Letter of request by the head of the institution

- NIC (Sri Lankans) or Valid Passport (Foreign Nationals) and the letter of appointment of the signatory

- Minutes of the AGM / Executive Report (if applicable)

- Registration certificate

- Confirmation of the branch issued by the head office (For Branches only)

- Act/Gazette for the establishment (For Government & Semi Government Institutions only)

- Joint Venture agreement and copies of TINs of the partners (For Joint Ventures only)

- Power of attorney for the signatory (For Joint Ventures and for Foreign Companies if applicable)

- Project agreement and cabinet approval etc. (For Projects only)

- Trust deed and NIC (Sri Lankans) or Valid Passport (Foreign Nationals) of the Trustees (For Trusts)

If you require any additional information or clarification, please contact our call center at 074 2000 930

Temporary VAT registration

- For Imports: Bill of landing / Airway bill

- For Exports: Purchase order / Purchase agreement

Temporary VAT provided to persons undertaking following activities shall not be required henceforth as per the letter (CGIR/2020/2-2) of Commissioner General of Inland Revenue to Director General of Customs, dated 23.11.2020.

- Customs Clearance and related activities

- Ship agents and sub agents

- Clearance agencies and wharf representatives

- Entities registered with the Board of Investment (BOI) and undertake import and export activities

- Warehouse operators

- Courier agents

If you require any additional information or clarification, please contact our call center at 074 2000 930

Submit the annual Income Tax Return

- This is an online Submission. Pls Select “Online” the Service Location.

- Once the Booking is confirmed, we will arrange a Duthaya to visit you and help with this Online Submission . as SSID and Password. Submission date November 30th

If you require any additional information or clarification, please contact our call center at 074 2000 930

Submit VAT returns

- Need to Submit Quarterly,

- Physical Submission Possible and also Online Submission (Deadline 20th of following Month)

- If you are proceeding with is an online Submission. Pls Select “Online” the Service Location.

- Once the Booking is confirmed, we will arrange a Duthaya to visit you and help with this Online Submission.

If you require any additional information or clarification, please contact our call center at 074 2000 930

Submit Self Estimate Income tax returns

- Filled Statement of Estimated Income Tax Payable [SET_E]

If you require any additional information or clarification, please contact our call center 074 2000 930

Obtain a duplicate return

- Letter of authorizing Duthaya to submit the application behalf of you Template can be Download

If you require any additional information or clarification, please contact our call center at 074 2000 930

Obtain tax outstanding list

- Letter of authorizing Duthaya to submit the application behalf of you Template can be Download

If you require any additional information or clarification, please contact our call center at 074 2000 930

Obtain tax clearance certificate

- Letter of authorizing Duthaya to submit the application behalf of you Template can be Download

If you require any additional information or clarification, please contact our call center at 074 2000 930

To change Company’s Name and Address

- Letter of authorizing Duthaya to submit the application behalf of you Template can be Download

If you require any additional information or clarification, please contact our call center at 074 2000 930

Online submission (RAMIS) assistance

- This is an online Submission. Pls Select “Online” the Service Location.

- Once the Booking is confirmed , we will arrange a Duthaya to visit you and help with this Online Submission.

If you require any additional information or clarification, please contact our call center at 074 2000 930

How it Works

Anything moved in 3 easy steps.

- Request in the App

Select “Government Services “ from main menu and then “Services from the Inland Revenue Department” from the home page main menu of the Duthaya Mobile App. Set your pickup and drop-off points, select the vehicle, when you need it, and payment method.

- We’ll Take it From Here

Your Duthaya will arrive, and you can hand over your necessary paperwork to him/her so that he/she can complete your work safely and securely. We’ll see you when we arrive!

- Rate your Duthaya

We complete your tasks and deliver them to the location of your choice. Tell us about your encounter!